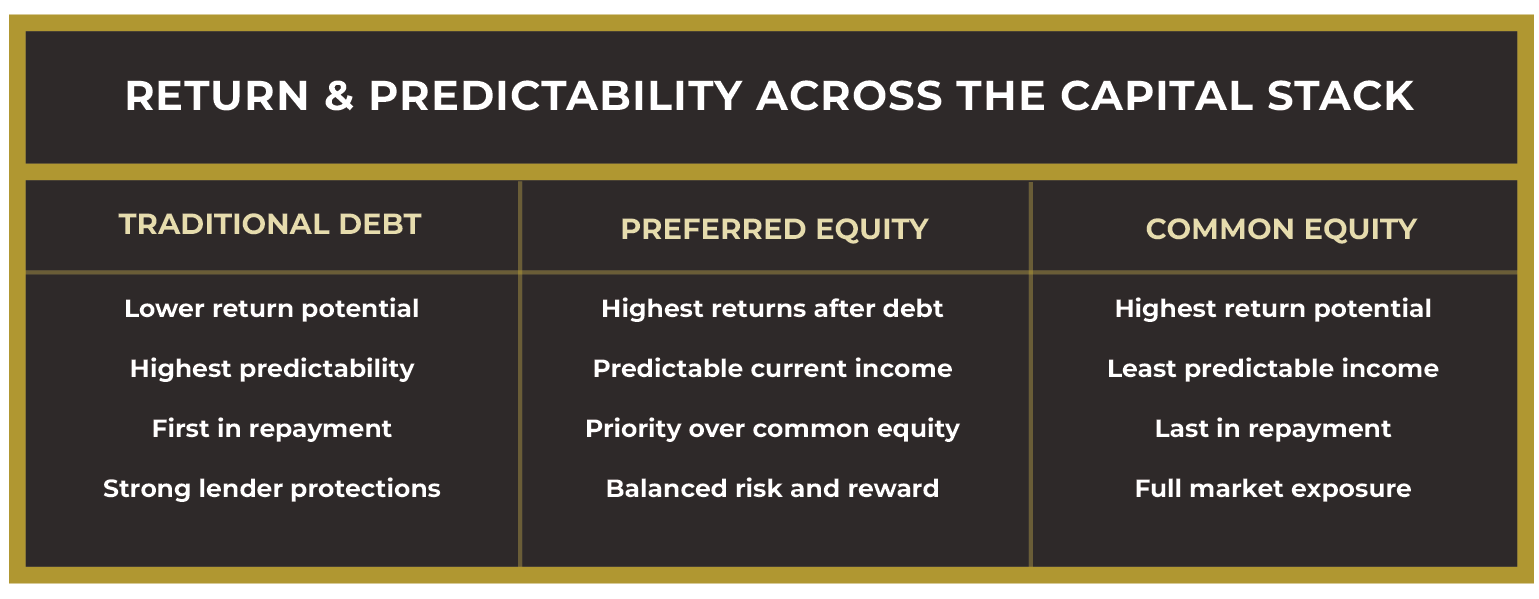

Preferred equity has become one of the most appealing ways for passive investors to participate in commercial real estate. It offers a blend of steady income, stronger structural protections, and a clearer path to liquidity than traditional equity. In an overall market where uncertainty remains elevated and long hold periods are common, preferred equity provides a thoughtful middle ground that balances return potential with risk management.

This week, we will explain why preferred equity is so attractive for investors and how it can help strengthen and diversify their real estate portfolio.

A Focus on Protecting Investor Capital

One major advantage of preferred equity is the focus on capital preservation. In the priority of cashflow distributions, preferred equity sits ahead of common equity, which means preferred equity investors receive their return of capital and all profits associated with the investment, before common equity holders see any distributions and ahead of any property-level GP/LP waterfall.

This structural priority offers an added sense of security. It helps cushion investors from valuation swings, business plan delays, increased costs or periods of market instability. While no investment eliminates risk, the preferred position creates a more protected starting point than common equity, where performance depends heavily on the success and timing of a project’s exit.

Consistent, Predictable Income

Preferred equity investments also provide reliability in income streams to investors, where traditional real estate investing (especially development/value-add execution) is highly unpredictable. It typically provides a fixed current return distributed on a regular basis, with additional accrual and profit at repayment. Because these payments are contractually defined, investors know what to expect and when to expect it.

This level of predictability can be especially valuable during times when market conditions are shifting or when traditional equity investments offer little clarity on when distributions might occur. Preferred equity brings structure and rhythm to income planning.

Potential Tax Advantages

Preferred equity may also offer attractive tax advantages, including potential capital gains treatment and access to depreciation benefits, which can enhance an investor’s after-tax yield. We will explore these considerations in depth in a separate article.

Diversification Without Added Responsibility

Preferred equity offers diversified exposure to multiple markets and operators without any management responsibilities. It provides a fully passive way to participate in real estate while avoiding the time and risk associated with direct ownership.

Aligned With Today’s Interest Rate Environment

Shorter durations help reduce sensitivity to long-term interest rate fluctuations and macro-level market shifts, allowing investors to redeploy capital more frequently. This can create a sense of flexibility and momentum in a portfolio, especially as new opportunities emerge.

How Armada Approaches Preferred Equity for Investors

At Armada, our work in preferred equity is grounded in a focus on investment structure and disciplined execution. We concentrate on opportunities where preferred equity can offer meaningful value in the lower middle market where capital needs are often underserved by larger institutions. This segment of the market allows for bespoke structuring, stronger alignment with experienced operators, and access to projects that benefit from a well-designed preferred position.

Our approach centers on partnering with real estate owners and developers who have compelling business plans and significant commitment to their projects. By structuring preferred equity investments with clearly defined protections and consistent current income, we aim to create a stable path for investor returns while supporting the success of the underlying project.

This is not a short-lived strategy. Preferred equity has become an increasingly important component of modern real estate capital stacks, offering a balance of protection and performance that aligns well with today’s environment. By focusing on this specialized area, we continue to refine a platform built on thoughtful underwriting, meaningful operator alignment, and a commitment to creating durable, risk-adjusted outcomes for our investors.

In our next post: we will explore how preferred equity investments create tax-efficient outcomes and support a more balanced long-term portfolio.