Most investors are familiar with debt and equity, you either lend money at a fixed return (debt) or own a portion of a property with potential upside (equity). Between those two financing tools, however, sits a powerful and often misunderstood hybrid: preferred equity.

Preferred equity combines characteristics of both debt and equity. It gives investors a higher priority of payment than common equity owners, but it’s subordinate to senior debt lenders. In other words, preferred equity investors are repaid after the bank but before the developer or sponsor receives any distribution. This middle position offers an appealing balance: lower risk than traditional equity, and higher returns than debt.

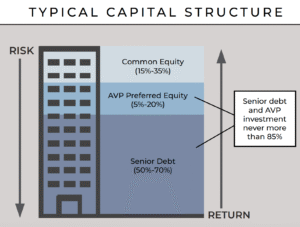

Think of the capital stack like a building (as shown in the image). At the foundation is Senior Debt, typically comprising 50-70% of the total capitalization. Above that is Preferred Equity, generally 5-20%. At the top sits Common Equity, the riskiest but most profitable layer, usually 15-35%. Together, senior debt and preferred equity typically account for no more than 85% of a project’s total capital structure.

Think of the capital stack like a building (as shown in the image). At the foundation is Senior Debt, typically comprising 50-70% of the total capitalization. Above that is Preferred Equity, generally 5-20%. At the top sits Common Equity, the riskiest but most profitable layer, usually 15-35%. Together, senior debt and preferred equity typically account for no more than 85% of a project’s total capital structure.

When Preferred Equity Comes Into Play

Preferred equity has become a vital tool for sponsors and developers navigating today’s capital markets. It’s especially useful in three scenarios:

1. New Construction

Development projects often begin years before breaking ground. By the time construction financing is secured, developers may have already deployed much of their original equity into land and pre-development costs. With higher construction costs and tighter lending standards, more equity is required to get projects capitalized and started. Preferred equity fills this gap, providing the needed capital without forcing developers to overly dilute their ownership through new common equity.

2. Refinancing

Many property owners are now facing loan maturities on debt originated during periods of historically low interest rates. Refinancing those loans in today’s higher-rate environment often requires additional capital, a “cash-in refinance.” Preferred equity provides that capital infusion, allowing owners to recapitalize and retain their properties while waiting for more favorable capital market conditions.

3. Value-Add Opportunities

Value-add projects involve improving or repositioning a property to increase its value and income. Preferred equity can fund these improvements, allowing sponsors to execute their business plan efficiently. Once the property is stabilized and generating stronger income, cheaper long-term refinancing (based on a higher valuation due to the improvements) can replace the existing loan and preferred equity investment, enabling sponsors to preserve their ownership and control future upside.

How Armada Is Leveraging This Opportunity

At Armada, we specialize in structuring and investing in preferred equity across institutional-quality commercial real estate projects nationwide. Our focus is on the lower middle market, where the demand for flexible, creative capital is strongest, particularly in deals requiring sub-$10 million equity checks that have been largely underserved by institutional players.

We’re partnering with experienced sponsors and developers who need bridge capital to unlock value, stabilize properties, or move shovel-ready projects forward. Preferred equity allows Armada to deliver a mutually beneficial solution: we provide sponsors with the capital and flexibility they need to advance their business plans, while giving our investors access to high-yield, risk-adjusted opportunities that sit senior to common equity.

This is not just a short-term opportunity; it’s a structural shift. Preferred equity has become an essential layer in modern real estate finance, reshaping how projects are capitalized and how investors participate in them. By focusing exclusively on this segment, Armada has positioned itself as an expert in an area that demands both creativity and discipline.

We target high-quality sponsors with strong track records and compelling business plans, but who need capital solutions seldom seen in the lower middle-market. In doing so, we’re bridging a crucial financing gap in today’s market and creating meaningful value for both sides of the equation.

Next week: why preferred equity has become one of the most compelling investment opportunities in today’s market and what’s driving the demand.