In today’s commercial real estate market, owners and developers face one of the most complex and challenging financing environments in recent memory. With traditional lenders tightening credit and borrowing rates and construction costs remaining elevated, accessing sufficient capital to move projects forward has become increasingly difficult. Preferred equity has emerged as a vital solution, providing the flexibility, speed, and structure necessary to keep projects on track without diluting ownership.

Diversifying the Capital Stack

Preferred equity allows real estate owners (“Operating Partners”) to strategically balance their capital stack between senior debt and common equity. By adding a preferred equity layer, Operating Partners can reduce their overall risk exposure while enhancing a project’s financial stability and preserving common equity upside potential. This hybrid structure provides a valuable alternative when equity shortfalls arise during acquisitions, recapitalizations, or construction/renovations; situations that have become increasingly common in today’s environment.

Beyond bridging shortfalls, preferred equity can make otherwise stalled projects viable. When traditional lenders or investors hesitate to increase their positions due to market constraints, preferred equity can fill the gap in the capital stack and enable execution. This capital diversification gives owners the flexibility to keep projects advancing.

Enhancing Project Viability

In many cases, preferred equity is the difference between a stalled project and a successful one. Whether an Operating Partner is facing a funding gap before closing a loan, a cost overrun during construction, or a refinancing hurdle at maturity, preferred equity provides the critical capital needed to move forward. Because it sits behind senior debt but ahead of common equity, it enables Operating Partners to maintain control of their project while accessing the capital required to complete their business plan.

This flexibility is particularly valuable today, where higher interest rates and conservative underwriting have limited leverage across most property types. Preferred equity can make a project feasible without forcing owners to raise costly common equity or sell off portions of their stake.

A Better Alternative to Mezzanine Debt

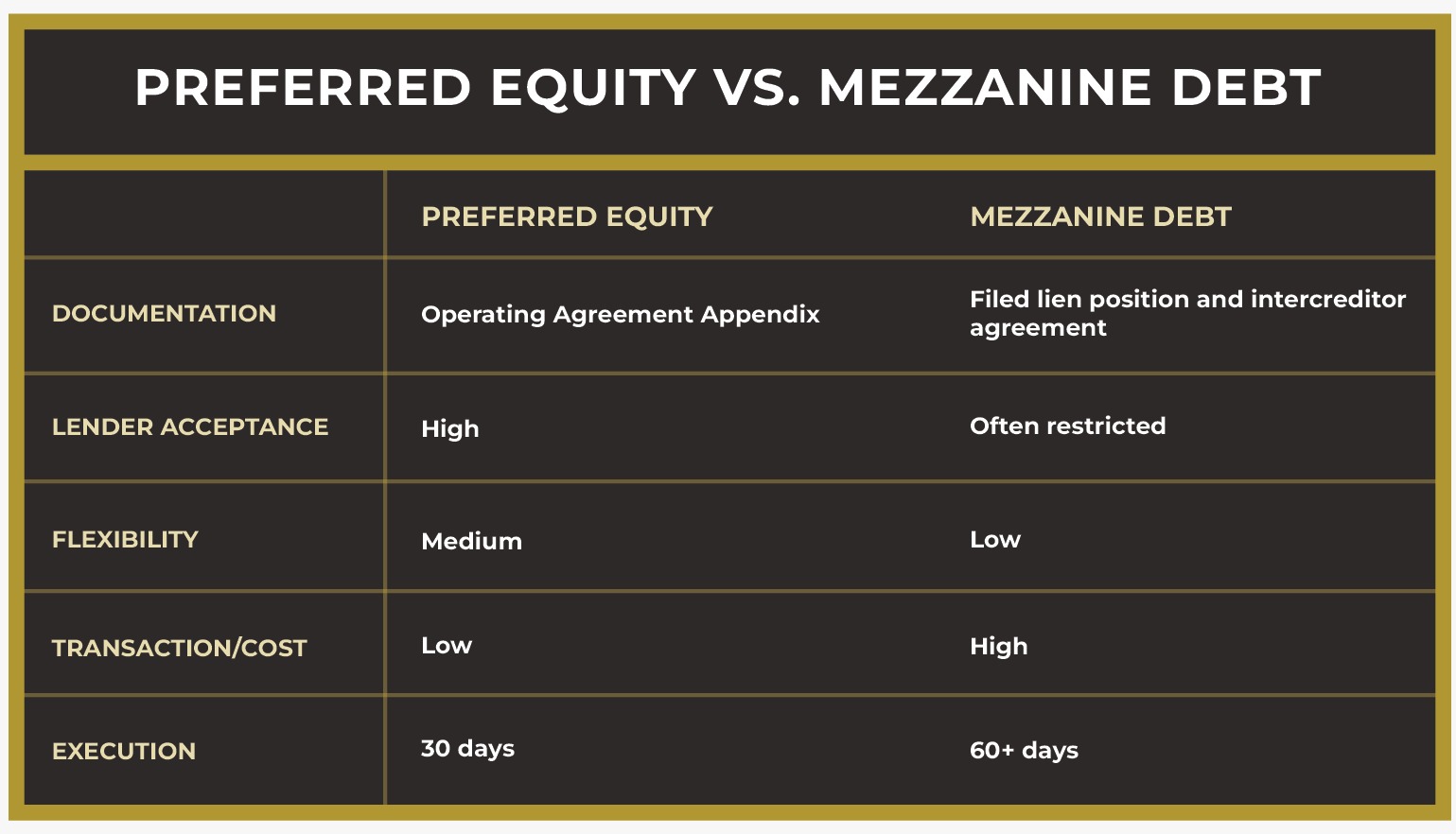

For many real estate owners, preferred equity is a more efficient and flexible solution than mezzanine debt. While mezzanine loans are secured by a secondary mortgage (something many banks prohibit), preferred equity is structured through the borrower/owner’s operating agreements with lender recognition rather than recorded on title. This approach offers legal and operational advantages, allowing deals to close quicker, less costly, and with fewer encumbrances on the property.

Preferred equity also offers more tailored terms. Unlike mezzanine debt, which has rigid repayment schedules, preferred equity terms can be tailored around project timelines, performance milestones, and anticipated refinance events.

Attracting Senior Debt

In today’s cautious lending environment, having preferred equity in the capital stack can actually make a project more attractive to senior lenders. The presence of a preferred equity partner demonstrates additional financial support and alignment, signaling to lenders that a project is better capitalized and more resilient. As a result, borrowers may find it easier to secure senior financing or negotiate more favorable terms.

Preserving Capital and Control

Preferred equity provides owners a cost-effective way to raise additional capital without diluting their common equity position. For owners with a long-term hold business plan, this structure protects ownership interests while providing the liquidity needed to execute a construction/value-add strategy, but the ability to retain control of a project (and future upside) long-term. This makes preferred equity particularly appealing compared to taking on new joint venture partners, who participate in future cashflows.

Flexible Terms and Tailored Solutions

No two real estate projects are alike, and preferred equity reflects that reality. Terms can be structured around the specific needs of the transaction, including preferred return rates, current pay percentages, and exit timelines. This adaptability makes preferred equity one of the most versatile financing tools available to real estate owners today.

Armada’s Role in Delivering Flexible Capital

At Armada, we provide real estate owners with the flexible, non-dilutive capital they need to move projects forward, quickly and efficiently. Our preferred equity structures are designed to be attractive to both sides of the transaction: we help Operating Partners preserve ownership and maintain control, while offering investors strong, risk-adjusted returns supported by real assets.

By focusing on the underserved lower middle market and partnering with experienced developers and owners nationwide, Armada delivers tailored capital solutions that strengthen project viability and reduce execution risk. In a market where certainty and creativity are in short supply, preferred equity creates a clear path forward for Operating Partners and investors alike.

Next week: we’ll break down why preferred equity is an advantageous for investors.