Preferred equity is often discussed in terms of its steady income, structural protections, and shorter investment horizon. But one of the most meaningful benefits for many investors is something less obvious: how the structure can improve after-tax outcomes compared to traditional income-producing investments.

While tax considerations always depend on the specific deal structure and each individual’s personal situation, there are several features commonly associated with preferred equity that may contribute to a more efficient tax profile. In this article, we explore those possibilities at a high level.

Deferred Taxation on Current Pay

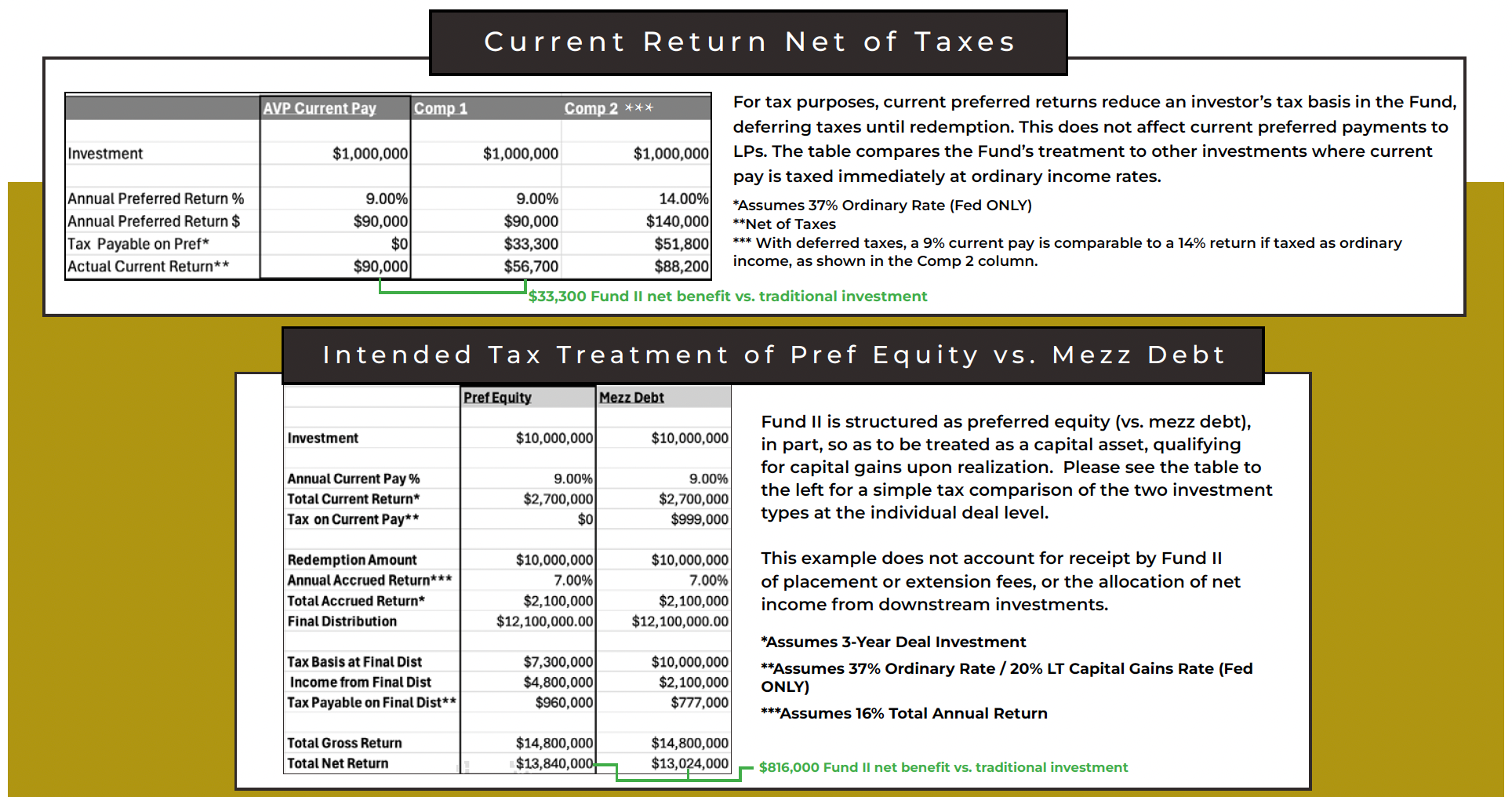

A unique aspect of many preferred equity structures is that quarterly preferred returns are not always taxed as ordinary income when received. Instead, those distributions frequently reduce an investor’s tax basis in the investment until their original capital has been returned.

This can delay tax recognition until the investment is realized, giving investors the potential benefit of receiving regular cash flow in the near term while deferring taxes to a later date. For individuals focused on compounding or reinvesting cash flow, this timing advantage can be meaningful.

Potential for Capital Gains Treatment and Key Differences From Mezzanine Debt

Another important aspect of preferred equity is the way gains are often treated at the end of the investment. In many preferred equity structures, the profit recognized upon realization can qualify for capital gains tax treatment, which is typically more favorable than ordinary income rates. This is a meaningful distinction, especially for investors comparing preferred equity to mezzanine debt or private lending investments.

Mezzanine or private debt produces interest income, and interest is usually taxed at an investor’s ordinary income rate. Ordinary income tax treatment can reduce the amount of return an investor ultimately keeps. Preferred equity, by contrast, is often structured so that gains recognized at exit receive capital gains treatment, resulting in a lower tax burden and a potentially higher after-tax yield.

When combined with the possibility of deferred taxation on quarterly distributions, preferred equity can provide a materially different tax profile compared to mezzanine lending, even when the face returns appear similar.

Exposure to Depreciation Benefits

Because preferred equity is tied to real estate assets, investors may also benefit from depreciation generated at the project level. Depreciation can offset portions of taxable income, improving after-tax yield and providing an additional layer of efficiency not commonly found in credit or fixed-income products.

Whether the depreciation is significant or modest depends on the nature of the underlying property, but the ability to participate in these deductions is one of the ways preferred equity can resemble real estate ownership without the operational burden.

Why This Matters for Investors Today

In a higher-rate environment where many investors are rethinking how much tax drag erodes their returns, structures that defer or reduce taxable income can play a valuable role. Preferred equity combines the consistency of recurring distributions with the possibility of more favorable tax outcomes, all within an investment sleeve that aims to offer more protection than common equity and more upside than traditional debt.

How Armada Applies These Principles in Fund II

Through AVP Opportunity Fund II, Armada structures preferred equity investments with the intention of creating clarity and efficiency around how distributions and gains may be treated for tax purposes. Preferred returns are designed to be distributed quarterly, and the structure is intended to allow gains to be recognized upon realization. Investors may also receive depreciation benefits associated with the underlying real estate projects.

Our goal is to offer a thoughtful, well-designed approach that aligns the strengths of preferred equity with a tax profile that can enhance an investor’s long-term outcomes, all while maintaining the income stability and downside protection that define the strategy.

Disclosure

THE FOREGOING DISCUSSION IS BASED ON THE MANAGER’S PRIOR EXPERIENCE. AVP CANNOT GUARANTY A SIMILAR OUTCOME IN FUND II. FURTHER, AVP DOES NOT PROVIDE TAX ADVICE AND YOU ARE URGED TO CONSULT WITH YOUR OWN TAX ADVISORS REGARDING THE TAX CONSEQUENCES OF AN INVESTMENT IN FUND II BEFORE DECIDING TO INVEST IN FUND II. THE FOREGOING DISCUSSION DOES NOT INCLUDE ALL THE POTENTIAL TAX CONSIDERATIONS RELEVANT TO FUND II.